Multiple Choice

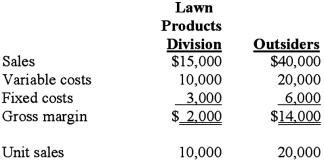

The Blade Division of Dana Company produces hardened steel blades. Approximately one-third of the Blade Division's output is sold to the Lawn Products Division of Dana; the remainder is sold to outside customers. The Blade Division's estimated sales and cost data for the year ending June 30 are as follows:  The Lawn Products Division has an opportunity to purchase 10,000 identical quality blades from an outside supplier at a cost of $1.25 per unit on a continual basis. Assume that the Blade Division cannot sell any additional products to outside customers. Based solely on short-term financial considerations, should Dana allow its Lawn Products Division to purchase the blades from the outside supplier, and why?

The Lawn Products Division has an opportunity to purchase 10,000 identical quality blades from an outside supplier at a cost of $1.25 per unit on a continual basis. Assume that the Blade Division cannot sell any additional products to outside customers. Based solely on short-term financial considerations, should Dana allow its Lawn Products Division to purchase the blades from the outside supplier, and why?

A) Yes, because buying the blades would save Dana Company $500.

B) No, because making the blades would save Dana Company $1,500.

C) Yes, because buying the blades would save Dana Company $2,500.

D) No, because making the blades would save Dana Company $2,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Relevant (i.e., differential) cost analysis:<br>A) Takes all

Q6: Keego Enterprises manufactures two products, boat wax

Q23: In a manufacturing environment, the short-term profit-maximizing

Q24: Diamond Company has three product lines, A,

Q56: Joe Green Enterprises has met all production

Q62: Apex Manufacturing Corporation is considering a significant

Q76: Which of the following statements regarding "opportunity

Q103: A cost is not relevant for decision

Q115: In a "make-or-buy" decision:<br>A) Only variable costs

Q126: Which one of the following is most