Essay

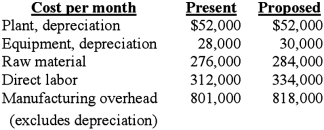

Apex Manufacturing Corporation is considering a significant shift in the mix of products it manufactures. The costs associated with current and proposed production schedules are shown below by category:  The proposed production will require a one-time purchase of equipment costing $180,000. No change in selling or administrative cost from their present levels is expected.

The proposed production will require a one-time purchase of equipment costing $180,000. No change in selling or administrative cost from their present levels is expected.

Required:

1. What type of relevant cost analysis would be appropriate in this situation (special order, make-lease-buy, etc.)? Why?

2. What role does depreciation and equipment purchase cost play in this decision?

3. What is the minimum amount that revenue would have to increase per month to justify the proposed production schedule? Ignore taxes and the time value of money

Correct Answer:

Verified

.

Answer may vary

Feedback: 1. Either a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Answer may vary

Feedback: 1. Either a ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Relevant (i.e., differential) cost analysis:<br>A) Takes all

Q6: Keego Enterprises manufactures two products, boat wax

Q24: Diamond Company has three product lines, A,

Q38: One of the behavioral problems with relevant

Q42: HJM Auto Parts makes a muffler/pipe assembly

Q59: The Blade Division of Dana Company produces

Q76: Which of the following statements regarding "opportunity

Q103: A cost is not relevant for decision

Q111: Costs relevant to a make-versus-buy decision typically

Q115: In a "make-or-buy" decision:<br>A) Only variable costs