Essay

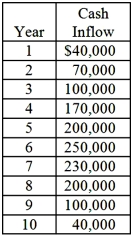

Nelson Inc.is considering the purchase of a $600,000 machine to manufacture a specialty tap for electrical equipment.The tap is in high demand and Nelson can sell all that it could manufacture for the next ten years, the government exempts taxes on profits from new investments.This legislation will most likely remain in effect in the foreseeable future.The equipment is expected to have ten years of useful life with no salvage value.The firm uses the double-declining-balance depreciation method and switches to the straight-line depreciation method in the last four years of the asset's 10-year life.Nelson uses a rate of 10% in evaluating its capital investments.The net cash inflows are expected to be as follows:  Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Required:

1. What is the estimated net present value (NPV) of this proposed investment, rounded to the nearest thousand (e.g., $34,480 = $34,000)?

2. What is the estimated internal rate of return (IRR) on this project, rounded to the nearest whole % (e.g., 20.34% = 20%; 20.52% = 21%, etc.)? (Note: Students would have to have access to Excel to answer this question.)

3. What is the present value payback period for this proposed investment, in years (rounded to one decimal place)?

Correct Answer:

Verified

In the solutions below, the PV factors f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q154: Slumber Company is considering two mutually exclusive

Q155: In situations where a firm specifies different

Q156: Within the context of capital budgeting, a

Q157: Which of the following is not used

Q158: All of the following capital budgeting decision

Q160: Tyson Company has a pre-tax net cash

Q161: Brandon Company is contemplating the purchase of

Q162: Which of the following can a cash

Q163: Quip Corporation wants to purchase a new

Q164: Quip Corporation wants to purchase a new