Essay

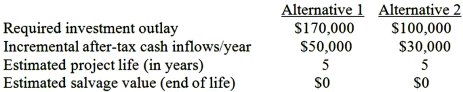

Slumber Company is considering two mutually exclusive investment alternatives.Its estimated weighted-average cost of capital, used as the discount rate for capital budgeting purposes, is 10%.Following is information regarding each of the two projects:  Required:

Required:

1.Compute the estimated net present value of each project and determine which alternative, based on NPV, is more desirable.(The PV annuity factor for 10%, 5 years, is 3.7908.)

2.Compute the profitability index (PI) for each alternative and state which alternative, based on PI, is more desirable.

3.Why do the project rankings differ under the two methods of analysis? Which alternative would you recommend, and why?

Correct Answer:

Verified

1.and 2.  Notes: a = $189,540 ÷ $170,000...

Notes: a = $189,540 ÷ $170,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q149: The Zone Company is considering the purchase

Q150: The term "breakeven after-tax cash flow" represents:<br>A)

Q151: Under conditions of capital rationing (i.e., limited

Q152: The annual tax depreciation expense on an

Q153: Marc Corporation wants to purchase a

Q155: In situations where a firm specifies different

Q156: Within the context of capital budgeting, a

Q157: Which of the following is not used

Q158: All of the following capital budgeting decision

Q159: Nelson Inc.is considering the purchase of a