Multiple Choice

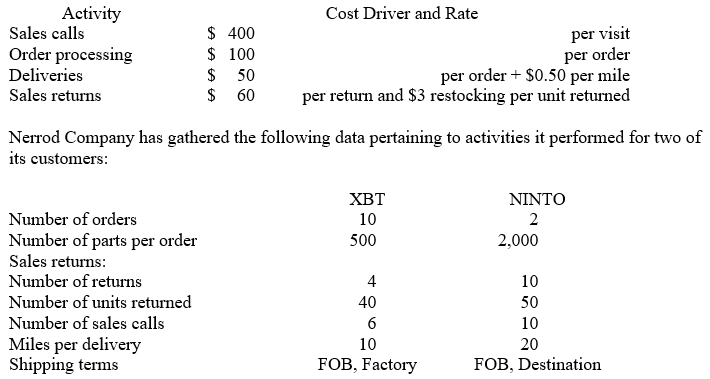

Nerrod Company sells its products at $500 per unit, net 30. The firm's gross margin ratio is 40 percent. The firm has estimated the following operating costs: What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

What is Nerrod's total sales-sustaining cost applicable to XBT as a customer?

A) $0.

B) $920.

C) $4,120.

D) $6,300.

E) $6,420.

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Sheen Co. manufacturers laser printers. It has

Q67: Wings Co. budgeted $555,600 manufacturing direct wages,

Q68: Orange, Inc. has identified the following cost

Q69: Effective implementation of activity-based costing (ABC) requires:<br>A)Normally

Q70: Which of the following would likely be

Q72: Customer profitability analysis:<br>A)Always shows that the company

Q73: asternik Company produces and sells two

Q74: Two students in a cost accounting class

Q75: Nerrod Company sells its products at $500

Q76: General corporate sales expenditures are:<br>A)Customer unit-level costs.<br>B)Customer