Not Answered

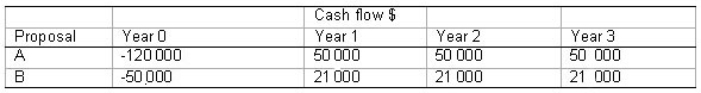

A company is to evaluate the following mutually exclusive investment proposals.The required rate of return is 10%. Calculate each proposal's net present value and internal rate of return.

Calculate each proposal's net present value and internal rate of return.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q55: What is the approximate internal rate of

Q56: Project B has a cost of $23

Q57: A company should approve all projects with

Q58: The internal rate of return is the

Q59: The problems associated with ranking mutually exclusive

Q60: What is the net present value of

Q61: Capital-expenditure management involves which of the following?<br>A)Determining

Q62: Benefit-cost ratio is calculated by:<br>A)dividing the present

Q63: Net present value and internal rate of

Q65: Which of the following statements in regard