Essay

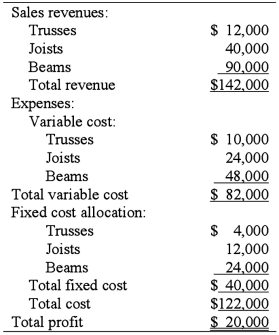

Lester-Smith Company manufactures three wood construction components: wood trusses, wood floor joists, and beams. The plant is operating at full capacity. It can produce 200 trusses, 1,000 joists, and 600 beams per month and sells everything it produces. The monthly revenues and expenses for the three products are  Required:

Required:

1. The firm makes wood trusses mainly to satisfy certain customers by offering a full line of wood components. Lately, it has had a problem making a profit on the trusses and is considering buying them from another manufacturer at $55 a truss. Based solely on a short-term financial analysis, should the firm buy these trusses or continue to make its own? (Show calculations.)

2. Lester-Smith has an opportunity to produce an additional 400 beams for a customer at a price of $100 each. If it accepts this special order, the firm cannot produce trusses because the plant will be operating at full capacity. Should the firm accept this special order? (Show calculations.)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: A company's approach to a make-or-buy decision:<br>A)

Q37: A company owns equipment that is used

Q47: In deciding whether to manufacture a part

Q48: In a sell-or-process-further decision, joint production costs:<br>A)

Q49: The Robinson-Patman Act, administered by the U.S.

Q82: Preston Industries, Inc. currently manufactures part QX100,

Q89: A recent article in The McKinsey Quarterly,

Q111: Costs relevant to a make-versus-buy decision typically

Q123: The opportunity cost of making a component

Q136: Management accountants are frequently asked to analyze