Essay

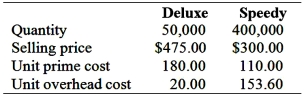

Volume-Based Costing Versus ABC: Gorden Company produces a variety of electronic products. One of its plants produces two laser printers, Speedy and Deluxe. At the beginning of 2013, the following data were prepared for this plant:  The unit overhead cost is calculated using the predetermined overhead application rate based on direct labor-hours.

The unit overhead cost is calculated using the predetermined overhead application rate based on direct labor-hours.

Upon examining the data, the marketing manager was particularly impressed with the per-unit profitability of the Deluxe printer and suggested that more emphasis be placed on producing and selling this product. The plant supervisor objected to this strategy, arguing that the Deluxe model required a very delicate manufacturing process. The supervisor believed that the cost of the Deluxe printer was likely to be much higher than reported.

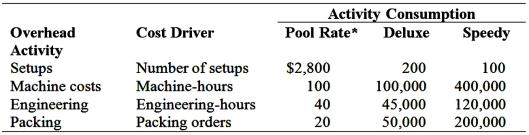

The controller suggests an activity-based costing system and provides the following budget data pertaining to the period:  * Cost per unit of cost driver

* Cost per unit of cost driver

Required:

1. Using the projected data based on the firm's current costing system, calculate gross profit per unit and gross profit percentage for each product. Round calculations to 2 decimal places.

2. Using the suggested multiple cost drivers' overhead rates, calculate the overhead cost per unit for each product and determine gross profit per unit and gross profit percentage for each product.

3. Based on your results, evaluate the suggestion of the marketing manager to emphasize the Deluxe model.

4. How does ABC contribute to Gorden's competitive advantage?

Correct Answer:

Verified

Answer may vary

Feedback: 1. Current cos...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Feedback: 1. Current cos...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Wings Co. budgeted $555,600 manufacturing direct wages,

Q56: All of the following statements regarding activity-based

Q69: Effective implementation of activity-based costing (ABC) requires:<br>A)Normally

Q71: Nerrod Company sells its products at $500

Q84: Scott Cameras produces digital cameras and have

Q88: Which of the following would be the

Q102: A firm has many products, some produced

Q104: Shaver Co. manufactures a variety of electric

Q114: Everlast Co. manufactures a variety of drill

Q130: An activity that is performed to support