Multiple Choice

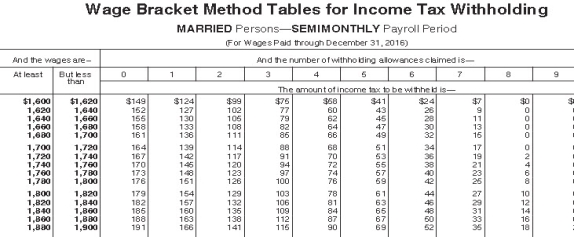

Trish earned $1,734.90 during the most recent semimonthly pay period.She is married and has 3 withholding allowances and has no pre-tax deductions.Based on the following table,how much should be withheld from her gross pay for federal income tax?

A) $91.00

B) $89.00

C) $95.00

D) $69.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: The amount of federal income tax decreases

Q35: Amity is an employee with a period

Q57: Vivienne is a full-time exempt employee in

Q58: A retirement plan that allows employees to

Q60: Which of the following is used in

Q60: Post-Tax Deductions are amounts _.<br>A) That are

Q61: If a firm has fewer than 100

Q62: Health Savings Accounts may be used as

Q64: Which Act extended health care benefits to

Q65: Steve is a full-time exempt employee at