Multiple Choice

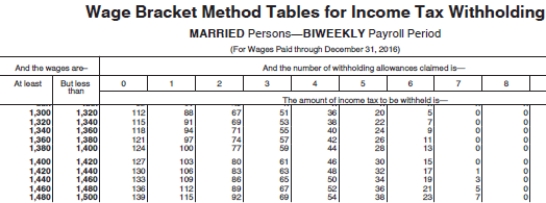

Vivienne is a full-time exempt employee in DeKalb County,Indiana,and is paid biweekly.She earns $39,000 annually,and is married with 2 withholding allowances.Her state income tax deduction is $44.46,and the DeKalb County income tax deduction is $19.62.What is the total amount of her FICA,federal,state,and local taxes per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine the federal tax deduction.Do not round intermediate calculations,only round final answer to two decimal points. )

A) $239.83

B) $320.83

C) $265.83

D) $270.83

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The amount of federal income tax decreases

Q25: What role does the employer play regarding

Q52: Which of the following guidelines does the

Q58: A retirement plan that allows employees to

Q59: Trish earned $1,734.90 during the most recent

Q60: Which of the following is used in

Q60: Post-Tax Deductions are amounts _.<br>A) That are

Q61: If a firm has fewer than 100

Q62: Health Savings Accounts may be used as

Q65: Steve is a full-time exempt employee at