Multiple Choice

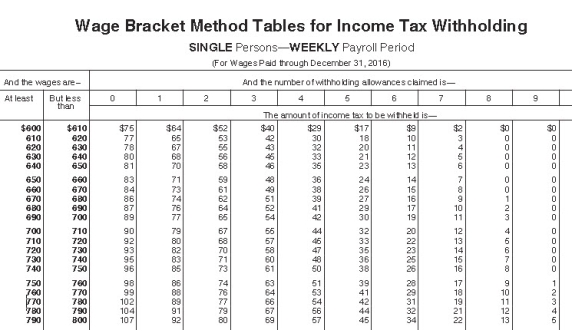

Andie earned $680.20 during the most recent weekly pay period.She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan.If she chooses the method that results in the lowest taxable income,how much will be withheld for federal income tax (based on the following table) ?

A) $52.00

B) $60.00

C) $49.00

D) $47.00

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Retirement fund contributions are considered Pre-Tax Deductions

Q14: Collin is a full-time exempt employee in

Q17: Brent is a full-time exempt employee in

Q18: The wage-bracket of determining federal tax withholding

Q29: Jesse is a part-time nonexempt employee in

Q30: Best practices for paying employees by check

Q33: What is an advantage of direct deposit

Q36: A firm has headquarters in Indiana,but has

Q60: The factors that determine an employee's federal

Q62: From the employer's perspective,which of the following