Multiple Choice

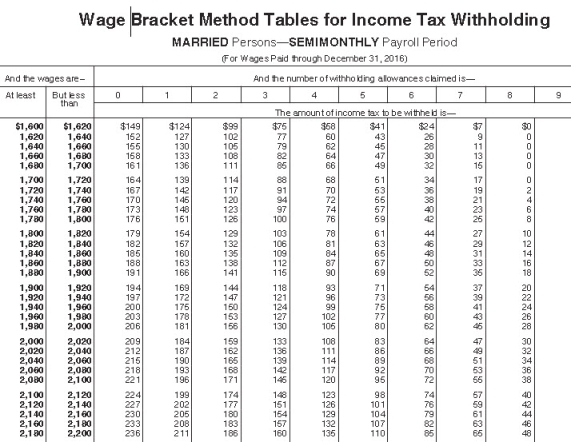

Brent is a full-time exempt employee in Clark County,Indiana.He earns an annual salary of $48,000 and is paid semimonthly.He is married with 3 withholding allowances.His state income tax per pay period is $57.38,and Clark County income tax is $33.75 per pay period.What is the total of FICA,federal,state,and local deductions per pay period,assuming no Pre-Tax Deductions? (Use the wage-bracket table to determine federal taxes.Do not round intermediate calculations,only round final answer to two decimal points. )

A) $369.36

B) $306.13

C) $325.13

D) $374.13

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Retirement fund contributions are considered Pre-Tax Deductions

Q14: Collin is a full-time exempt employee in

Q16: Andie earned $680.20 during the most recent

Q18: The wage-bracket of determining federal tax withholding

Q21: What is a disadvantage to using paycards

Q29: Jesse is a part-time nonexempt employee in

Q30: Best practices for paying employees by check

Q33: What is an advantage of direct deposit

Q36: A firm has headquarters in Indiana,but has

Q62: From the employer's perspective,which of the following