Multiple Choice

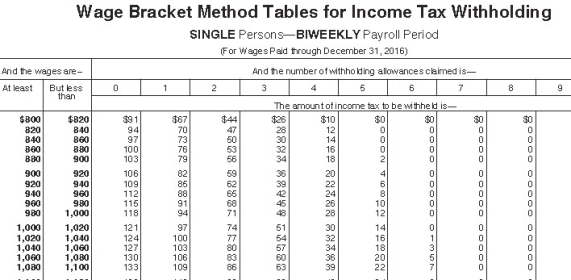

Julian is a part-time employee in Nashville,Tennessee,who earns $21.50 per hour.During the last biweekly pay period he worked 45 hours.He is single with one withholding allowance (use the wage-bracket table) .What is his net pay? (Do not round interim calculations,only round final answer to two decimal points. )

A) $818.40

B) $797.18

C) $825.99

D) $802.49

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the Consumer Credit Protection Act,what

Q21: What is a disadvantage to using paycards

Q22: Social Security tax has a wage base,

Q24: Amanda is a full-time exempt employee in

Q25: Danny is a full-time exempt employee in

Q30: Federal income tax,Medicare tax,and Social Security tax

Q31: Natalia is a full-time exempt employee who

Q35: Which of the following may be included

Q50: Paolo is a part-time security guard for

Q65: Adam is a part-time employee who earned