Multiple Choice

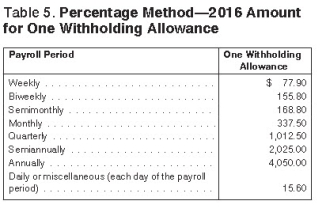

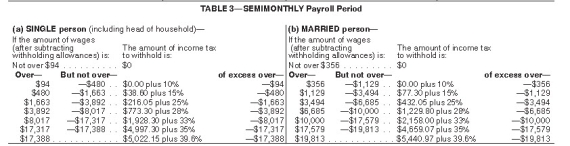

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round interim calculations,only round final answer to two decimal points. )

A) $2,245.53

B) $2,403.95

C) $2,360.87

D) $2,178.90

Correct Answer:

Verified

Correct Answer:

Verified

Q1: According to the Consumer Credit Protection Act,what

Q21: What is a disadvantage to using paycards

Q24: Amanda is a full-time exempt employee in

Q27: Julian is a part-time employee in Nashville,Tennessee,who

Q30: Best practices for paying employees by check

Q30: Federal income tax,Medicare tax,and Social Security tax

Q35: Which of the following may be included

Q36: A firm has headquarters in Indiana,but has

Q50: Paolo is a part-time security guard for

Q65: Adam is a part-time employee who earned