Multiple Choice

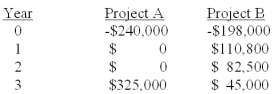

You are considering two mutually exclusive projects with the following cash flows.Will your choice between the two projects differ if the required rate of return is 8% rather than 11%? If so,what should you do?

A) Yes; Select A at 8% and B at 11%.

B) Yes; Select B at 8% and A at 11%.

C) Yes; Select A at 8% and select neither at 11%.

D) No; Regardless of the required rate, project A always has the higher NPV.

E) No; Regardless of the required rate, project B always has the higher NPV.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The Ziggy Trim and Cut Company can

Q40: You would like to invest in the

Q41: The internal rate of return tends to

Q44: Jack is considering adding toys to his

Q45: You are trying to determine whether to

Q46: Based on the internal rate of return

Q47: The internal rate of return is:<br>A)more reliable

Q48: The discounted payback rule may cause:<br>A)the most

Q51: Academic theory states that net present value

Q83: A project produces annual net income of