Multiple Choice

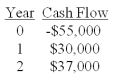

You would like to invest in the following project.  Victoria,your boss,insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted.She also insists on applying a 10% discount rate to all cash flows.Based on these criteria,you should:

Victoria,your boss,insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted.She also insists on applying a 10% discount rate to all cash flows.Based on these criteria,you should:

A) accept the project because it returns almost $1.22 for every $1 invested.

B) accept the project because it has a positive PI.

C) accept the project because the NPV is $2,851.

D) reject the project because the PI is 1.05.

E) reject the project because the IRR exceeds 10%.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Ginny Trueblood is considering an investment which

Q14: The Ziggy Trim and Cut Company can

Q35: Graphing the NPVs of mutually exclusive projects

Q36: Which one of the following statements is

Q41: The internal rate of return tends to

Q43: You are considering two mutually exclusive projects

Q44: Jack is considering adding toys to his

Q45: You are trying to determine whether to

Q51: Academic theory states that net present value

Q83: A project produces annual net income of