Multiple Choice

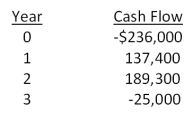

Blue Water Systems is analyzing a project with the following cash flows. Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 14 percent? Why or why not?

A) Yes; The MIRR is 13.48 percent.

B) Yes; The MIRR is 17.85 percent.

C) Yes; The MIRR is 21.23 percent.

D) No; The MIRR is 5.73 percent.

E) No; The MIRR is 17.85 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Western Beef Exporters is considering a project

Q42: You are viewing a graph that plots

Q55: You are considering the following two mutually

Q56: You are analyzing the following two mutually

Q57: A project has average net income of

Q61: An investment project provides cash flows of

Q61: What is the net present value of

Q63: What is the net present value of

Q83: Rossiter Restaurants is analyzing a project that

Q93: Tedder Mining has analyzed a proposed expansion