Multiple Choice

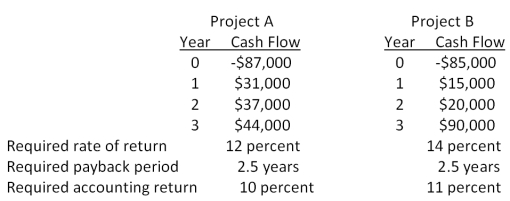

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on internal rate of return analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: There are two distinct discount rates at

Q45: The final decision on which one of

Q49: Which of the following are definite indicators

Q56: You are analyzing the following two mutually

Q57: A project has average net income of

Q60: Blue Water Systems is analyzing a project

Q61: An investment project provides cash flows of

Q73: The profitability index is most closely related

Q83: Rossiter Restaurants is analyzing a project that

Q99: Which of the following statements related to