Essay

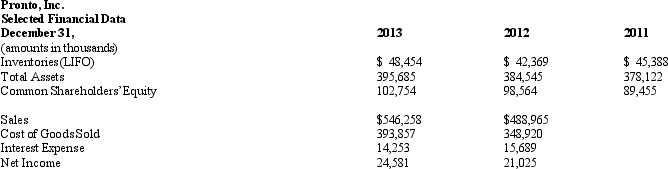

Pronto,Inc.is a major producer of printing equipment.Pronto uses a LIFO cost-flow assumption for inventories.The company's tax rate is 35%.Below is selected financial data for the company.

Required:

Required:

a.The excess of FIFO over LIFO inventories was $25 million on December 31,2013,$28.5 million on December 31,2012 and $22 million on December 31,2006.Compute the cost of goods sold for Pronto,Inc.for years 2013 and 2012 assuming that it had used a FIFO assumption.

b.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a LIFO cost-flow assumption.

c.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a FIFO cost-flow assumption.

d.Compute the rate of return on assets for years 2013 and 2012 based on the reported amounts.Disaggregate ROA into profit margin and asset turnover components.

e.Compute the rate of return on assets for years 2013 and 2012 assuming that Pronto,Inc.had used the FIFO method of accounting for inventories.Disaggregate ROA into profit margin and asset turnover components.

Correct Answer:

Verified

Required:

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Derivative instruments acquired to hedge exposure to

Q55: Which of the following will most likely

Q68: A large manufacturer recently changed its cost-flow

Q69: Magnum Construction contracted to construct a factory

Q70: The following information is available from Sheldon

Q71: Falcon Networks Falcon Networks is a leading

Q71: _ differences result from including revenues and

Q73: U.S.GAAP requires firms to report the assets

Q75: Funtime Corporation Assume that Funtime Corp.has agreed

Q76: Which of the following is not a