Essay

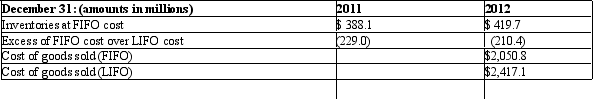

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Correct Answer:

Verified

Calculate the inventory turnover ratio f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Parnell Industries Parnell Industries sold a copy

Q64: The following information is taken from Satin

Q65: Gorilla,Corp.implemented a defined-benefit pension plan for its

Q66: Bower Construction Comp.has consistently used the percentage-of-completion

Q67: Falcon Networks Falcon Networks is a leading

Q69: Magnum Construction contracted to construct a factory

Q70: The following information is available from Sheldon

Q71: Falcon Networks Falcon Networks is a leading

Q73: U.S.GAAP requires firms to report the assets

Q73: Pronto,Inc.is a major producer of printing equipment.Pronto