Multiple Choice

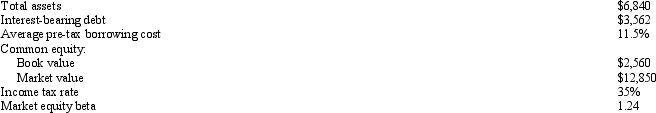

Zonk Corp. The following data pertains to Zonk Corp.,a manufacturer of ball bearings (dollar amounts in millions) : Determine the weight on equity capital that should be used to calculate Zonk's weighted-average cost of capital:

Determine the weight on equity capital that should be used to calculate Zonk's weighted-average cost of capital:

A) 21.7%

B) 78.3%

C) 41.8%

D) 50%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Suppose a firm has a market beta

Q3: For each of the following companies,determine the

Q6: For each of the following scenarios determine

Q6: Why is the dividends valuation approach applicable

Q7: Zonk Corp. The following data pertains to

Q8: Zonk Corp. The following data pertains to

Q11: The following financial statement data pertains to

Q19: Under the assumption of clean surplus accounting,how

Q26: Under the cash-flow-based valuation approach,free cash flows

Q50: Why do investors typically accept a lower