Essay

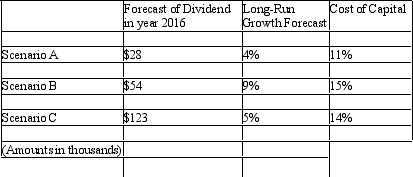

For each of the following scenarios determine the value as of the beginning of 2012 of the continuing dividend:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Suppose a firm has a market beta

Q2: Zonk Corp. The following data pertains to

Q3: For each of the following companies,determine the

Q6: Why is the dividends valuation approach applicable

Q7: Zonk Corp. The following data pertains to

Q8: Zonk Corp. The following data pertains to

Q11: The following financial statement data pertains to

Q19: Under the assumption of clean surplus accounting,how

Q26: Under the cash-flow-based valuation approach,free cash flows

Q50: Why do investors typically accept a lower