Essay

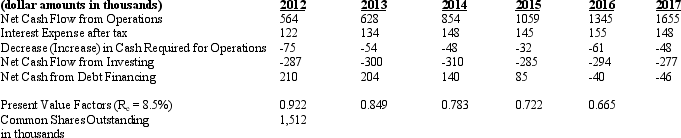

Shady Sunglasses operates retail sunglass kiosks in shopping malls.Below is information related to the company:

Using the above information and assuming that steady-state growth in year 2017 and beyond will be 4% calculate Shady Sunglasses value per share.

Using the above information and assuming that steady-state growth in year 2017 and beyond will be 4% calculate Shady Sunglasses value per share.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: One rationale for using expected dividends in

Q4: The CAPM computes expected rates of return

Q17: Zonk Corp. The following data pertains to

Q18: The following financial statement data pertains to

Q21: Zonk Corp. The following data pertains to

Q21: A company with a market beta of

Q27: Equity valuation models based on dividends,cash flows,and

Q30: Normally,valuation methods are designed to produce reliable

Q48: Why are dividends value-relevant to common equity

Q49: According to the text,dividends are value-relevant even