Multiple Choice

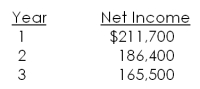

An investment has an initial cost of $3.2 million. This investment will be depreciated by $900,000 a year over the 3-year life of the project. Should this project be accepted based on the average accounting rate of return if the required rate is 10.5 percent? Why or why not?

A) Yes; because the AAR is 10.5 percent

B) Yes; because the AAR is less than 10.5 percent

C) Yes; because the AAR is greater than 10.5 percent

D) No; because the AAR is greater than 10.5 percent

E) No; because the AAR is less than 10.5 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Payback is best used to evaluate which

Q15: Which one of the following indicates that

Q55: Jefferson International is trying to choose between

Q58: Today, Crunchy Snacks is investing $487,000 in

Q60: Major Importers would like to spend $211,000

Q61: Which one of the following is true

Q63: The Auto Shop is buying some new

Q77: Which one of the following will occur

Q83: The payback period is the length of

Q91: Which one of the following statements is