Multiple Choice

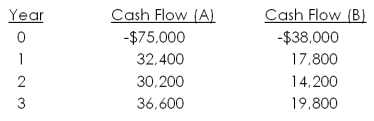

Jefferson International is trying to choose between the following two mutually exclusive design projects:  The required return is 12 percent. If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept?

The required return is 12 percent. If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept?

A) Project A; Project B; Project A

B) Project A; Project B; Project B

C) Project B; Project A; Project A

D) Project B; Project A; Project B

E) Project B; Project B, Project B

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Payback is best used to evaluate which

Q5: Both Projects A and B are acceptable

Q15: Which one of the following indicates that

Q50: You are considering the following two mutually

Q51: T.L.C., Inc. is considering an investment with

Q53: You are considering the following two mutually

Q58: Today, Crunchy Snacks is investing $487,000 in

Q59: An investment has an initial cost of

Q60: Major Importers would like to spend $211,000

Q77: Which one of the following will occur