Multiple Choice

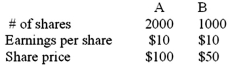

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is,after the merger,there are 2500 shares of A outstanding) .Suppose that the merger really does increase the value of the combined firms by $20,000..What is the cost of the merger?

A) zero

B) $2,000

C) $8,000

D) $4,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Following an acquisition,the acquiring firm's balance sheet

Q4: Merging in order to lower financing costs

Q6: The following are sensible motives for mergers

Q10: The DOC Corporation with a book value

Q41: The following are sensible motives for mergers:<br>I.prevent

Q44: A would-be acquirer making a tender offer

Q49: The main difference to shareholders between a

Q58: Discuss the difficulties associated with a typical

Q67: Firm A has a value of $100

Q76: Briefly explain the term economies of scale.