Multiple Choice

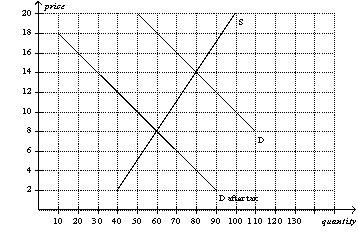

Figure 6-23

-Refer to Figure 6-23.The per-unit burden of the tax is

A) $4 for buyers and $6 for sellers.

B) $5 for buyers and $5 for sellers.

C) $6 for buyers and $4 for sellers.

D) $10 for buyers and $0 for sellers.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Under rent control,bribery is a mechanism to<br>A)bring

Q71: Suppose the government imposes a $40 tax

Q172: A tax imposed on the buyers of

Q180: An alternative to rent-control laws that would

Q229: A tax on buyers shifts the demand

Q277: If a price ceiling of $1.50 per

Q320: Workers, rather than firms, bear most of

Q399: If a tax is levied on the

Q406: Using the graph shown,answer the following questions.<br>a.What

Q408: Figure 6-11<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 6-11