Multiple Choice

Figure 8-7

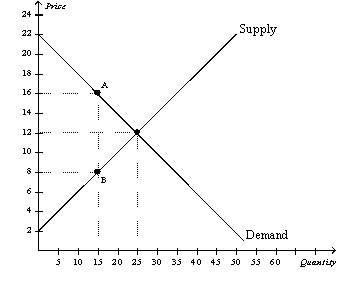

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7.As a result of the tax,buyers effectively pay

A) $16 for each unit of the good, and sellers effectively receive $12 for each unit of the good.

B) $16 for each unit of the good, and sellers effectively receive $8 for each unit of the good.

C) $12 for each unit of the good, and sellers effectively receive $8 for each unit of the good.

D) $14 for each unit of the good, and sellers effectively receive $10 for each unit of the good.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Taxes on labor encourage which of the

Q5: Labor taxes may distort labor markets greatly

Q11: Assume the supply curve for cigars is

Q44: In which of the following cases is

Q49: The marginal tax rate on labor income

Q83: When a tax is imposed on a

Q100: The loss in total surplus resulting from

Q195: The decrease in total surplus that results

Q243: Figure 8-8<br>Suppose the government imposes a $10

Q261: Figure 8-11<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2185/.jpg" alt="Figure 8-11