Multiple Choice

Figure 8-11

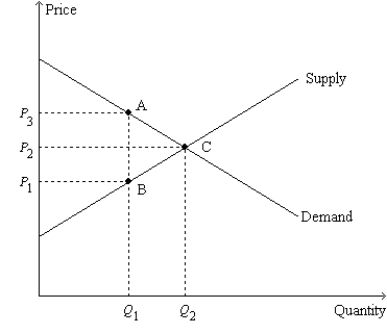

-Refer to Figure 8-11.Suppose Q1 = 4;Q2 = 7;P1 = $6;P2 = $8;and P3 = $10.Then,when the tax is imposed,

A) consumer surplus decreases by $11.

B) producer surplus decreases by $11.

C) the deadweight loss amounts to $6.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q69: Figure 8-8<br>Suppose the government imposes a $10

Q70: Figure 8-5<br>Suppose that the government imposes a

Q71: When a tax on a good is

Q72: Figure 8-9<br>The vertical distance between points A

Q73: Figure 8-6<br>The vertical distance between points A

Q75: Figure 8-3<br>The vertical distance between points A

Q76: Figure 8-9<br>The vertical distance between points A

Q77: A tax levied on the sellers of

Q78: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q79: Figure 8-8<br>Suppose the government imposes a $10