Short Answer

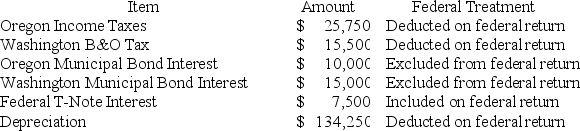

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500.Moss' Federal Taxable Income was $549,743.Calculate Moss' Oregon state tax base.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Separate return states require each member of

Q6: Roxy operates a dress shop in Arlington,Virginia.Lisa,a

Q7: Super Sadie,Incorporated manufactures sandals and distributes them

Q10: PWD Incorporated is an Illinois corporation.It properly

Q62: The sales and use tax base varies

Q83: What was the Supreme Court's holding in

Q110: Roxy operates a dress shop in Arlington,

Q115: Businesses subject to income tax in more

Q119: A state's apportionment formula usually is applied

Q120: Businesses engaged in interstate commerce are subject