Multiple Choice

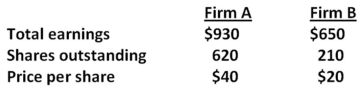

Consider the following premerger information about Firm A and Firm B:  Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock.Both A and B have no debt outstanding.What will the earnings per share of Firm A be after the merger?

Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock.Both A and B have no debt outstanding.What will the earnings per share of Firm A be after the merger?

A) $1.60

B) $1.86

C) $1.95

D) $2.02

E) $2.10

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The value of a target firm to

Q4: The Cycle Stop has 1,600 shares outstanding

Q6: Dressler,Inc.,is planning on merging with Weston Foods.Dressler

Q7: Dixie and ten of her wealthy friends

Q8: Melvin was attempting to gain control of

Q9: Assume the following balance sheets are stated

Q10: Which of the following statements correctly apply

Q11: The incremental cash flows of a merger

Q24: If an acquisition does not create value

Q70: In a merger the:<br>A) legal status of