Multiple Choice

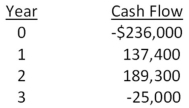

Blue Water Systems is analyzing a project with the following cash flows.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 14 percent? Why or why not?

A) Yes; The MIRR is 13.48 percent.

B) Yes; The MIRR is 17.85 percent.

C) Yes; The MIRR is 21.23 percent.

D) No; The MIRR is 5.73 percent.

E) No; The MIRR is 17.85 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Hungry Hoagie's has identified the following two

Q27: Which two methods of project analysis were

Q28: You are analyzing a project and have

Q29: You are considering the following two mutually

Q30: You are comparing two mutually exclusive projects.The

Q32: A firm evaluates all of its projects

Q33: The profitability index (PI)of a project is

Q35: Rosa's Designer Gowns creates exquisite gowns for

Q36: Samuelson Electronics has a required payback period

Q38: The internal rate of return: <br>A) may produce