Multiple Choice

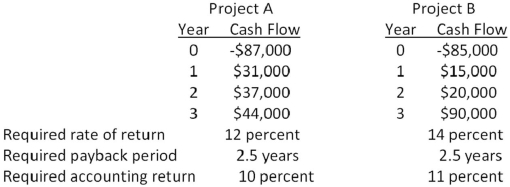

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on internal rate of return analysis.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The internal rate of return is defined

Q26: Hungry Hoagie's has identified the following two

Q27: Which two methods of project analysis were

Q28: You are analyzing a project and have

Q28: There are two distinct discount rates at

Q30: You are comparing two mutually exclusive projects.The

Q31: Blue Water Systems is analyzing a project

Q32: A firm evaluates all of its projects

Q33: The profitability index (PI)of a project is

Q38: The internal rate of return: <br>A) may produce