Multiple Choice

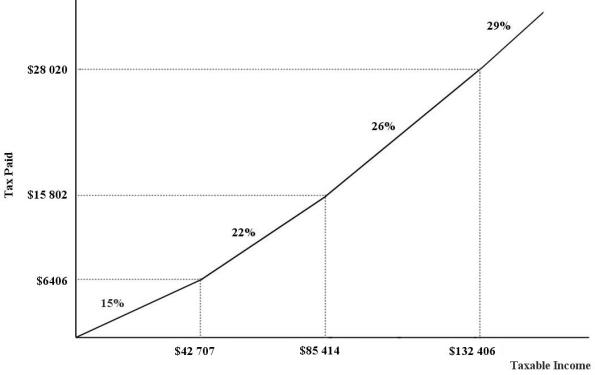

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

A) $0

B) $6122

C) $5925

D) $6109

E) $8690

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Suppose there is only one movie theatre

Q44: What is a demogrant?<br>A)A federal transfer to

Q45: In 2015,the federal income-tax rate was graduated

Q46: Which of the following is required to

Q47: The most important source of revenue for

Q49: The various provincial sales taxes are mildly

Q50: An income tax is progressive if,as income

Q51: Which of the following statements about the

Q52: The diagram below shows supply and demand

Q53: If there were "horizontal equity" between all