Multiple Choice

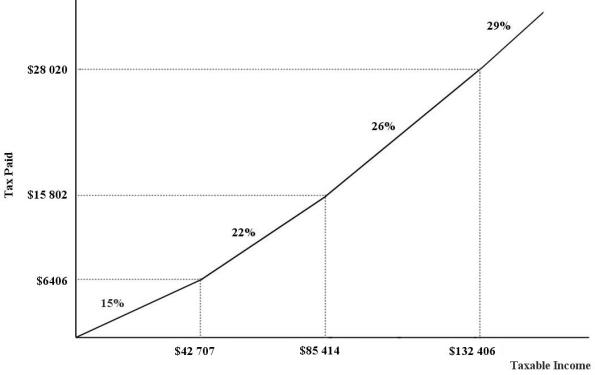

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.What must be true of the four marginal income-tax rates in order for the tax to be considered a "flat" tax?

A) they need to be zero

B) they need to be the same

C) they need to be constant

D) they need to gradually level out

E) they need to be smaller

Correct Answer:

Verified

Correct Answer:

Verified

Q59: From the perspective of individuals,the goods and

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 18-3 -Refer

Q61: A mandatory health-insurance premium of a given

Q62: The goods and services tax (GST)in Canada

Q63: The diagram below shows supply and demand

Q65: The figure below show a simplified version

Q66: A "poverty trap" refers to the situation

Q67: Statistics Canada defines the poverty line as

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5441/.jpg" alt=" FIGURE 18-1 -Refer

Q69: A tax that takes a higher percentage