Essay

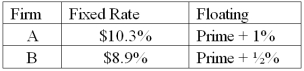

Consider the borrowing rates for Parties A and B.A wants to finance a $100,000,000 project at a FIXED rate.B wants to finance a $100,000,000 project at a FLOATING rate.Both firms want the same maturity,in 5 years.  Construct a mutually beneficial INTEREST ONLY swap that makes money for A,B,and the swap bank IN EQUAL MEASURE.

Construct a mutually beneficial INTEREST ONLY swap that makes money for A,B,and the swap bank IN EQUAL MEASURE.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Floating for floating currency swaps<br>A)the reference rates

Q40: Explain how firm A could use two

Q47: Examples of "single-currency interest rate swap" and

Q51: The term interest rate swap<br>A)refers to a

Q53: Suppose the quote for a five-year swap

Q54: Come up with a swap (principal +

Q58: The size of the swap market is<br>A)measured

Q60: Suppose that you are a swap bank

Q84: Explain how firm B could use the

Q90: Explain how this opportunity affects which swap