Multiple Choice

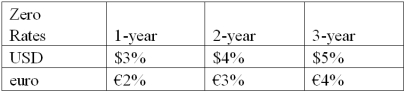

Suppose that you are a swap bank and you notice that interest rates on zero coupon bonds are as shown.Develop the 3-year bid price of a dollar swap quoted against flat USD LIBOR.  In other words,what will you be willing to pay in euro against receiving USD LIBOR?

In other words,what will you be willing to pay in euro against receiving USD LIBOR?

A) 5%

B) 4%

C) 3%

D) 2%

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Floating for floating currency swaps<br>A)the reference rates

Q40: Explain how firm A could use two

Q47: Examples of "single-currency interest rate swap" and

Q51: The term interest rate swap<br>A)refers to a

Q58: Consider the borrowing rates for Parties A

Q58: The size of the swap market is<br>A)measured

Q65: Compute the payments due in the second

Q84: Explain how firm B could use the

Q90: Explain how this opportunity affects which swap

Q97: Consider a fixed for fixed currency swap.