Multiple Choice

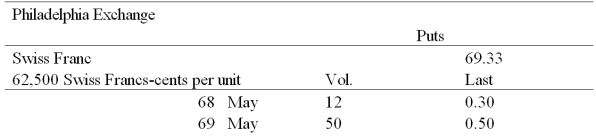

In the CURRENCY TRADING section of The Wall Street Journal,the following appeared under the heading OPTIONS:  Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

(ii) - The 68 May put option has a lower time value (price) than the 69 May put option.

(iii) - If everything else is kept constant,the spot price and the put premium are inversely related.

(iv) - The time values of the 68 May and 69 May put options are,respectively,1.63 cents and 0.83 cents.

(v) - If everything else is kept constant,the strike price and the put premium are inversely related.

A) (i) , (ii) , and (iii)

B) (ii) , (iii) , and (iv)

C) (iii) and (iv)

D) ( iv) and (v)

Correct Answer:

Verified

Correct Answer:

Verified

Q16: If the call finishes out-of-the-money what is

Q17: Yesterday, you entered into a futures contract

Q28: Find the input d<sub>1</sub> of the Black-Scholes

Q31: The volume of OTC currency options trading

Q32: The hedge ratio<br>A)Is the size of the

Q36: Find the value of a one-year put

Q37: Which of the lines is a graph

Q39: Value a 1-year call option written on

Q69: The Black-Scholes option pricing formulae<br>A)are used widely

Q98: USING RISK NEUTRAL VALUATION (i.e. the binomial