Multiple Choice

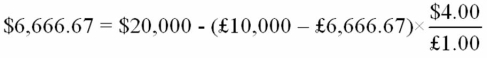

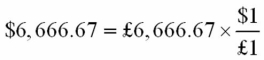

Value a 1-year call option written on £10,000 with an exercise price of $2.00 = £1.00.The spot exchange rate is $2.00 = £1.00; The U.S.risk-free rate is 5% and the U.K.risk-free rate is also 5%.In the next year,the pound will either double in dollar terms or fall by half (i.e.u = 2 and d = ½) .Hint: H = ⅔.

A) $6,349.21

B)

C)

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Yesterday, you entered into a futures contract

Q31: The volume of OTC currency options trading

Q35: In the CURRENCY TRADING section of The

Q36: Find the value of a one-year put

Q37: Which of the lines is a graph

Q50: If the call finishes in-the-money what is

Q51: Three days ago, you entered into a

Q76: Today's settlement price on a Chicago Mercantile

Q91: For European currency options written on euro

Q98: USING RISK NEUTRAL VALUATION (i.e. the binomial