Multiple Choice

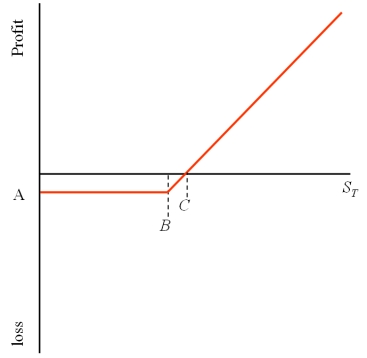

Consider the graph of a call option shown at right.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

A) A = -$3,125 (or -$.05 depending on your scale) ; B = $1.50; C = $1.55

B) A = -€3,750 (or -€.06 depending on your scale) ; B = $1.50; C = $1.55

C) A = -$.05; B = $1.55; C = $1.60

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Find the Black-Scholes price of a six-month

Q2: For European currency options written on euro

Q2: The current spot exchange rate is $1.55

Q21: Find the value today of your replicating

Q37: With currency futures options the underlying asset

Q49: Draw the binomial tree for this option.

Q59: Find the hedge ratio for a put

Q60: The current spot exchange rate is $1.55

Q61: Find the hedge ratio for a call

Q85: A European option is different from an