Multiple Choice

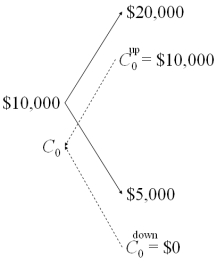

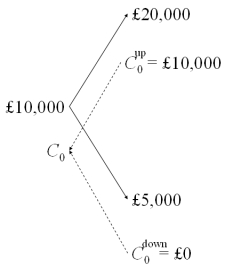

Draw the tree for a call option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: In which market does a clearinghouse serve

Q4: In the event of a default on

Q6: A CME contract on €125,000 with September

Q45: Empirical tests of the Black-Scholes option pricing

Q54: Verify that the dollar value of your

Q57: For European options, what of the effect

Q58: Find the hedge ratio for a put

Q75: Assume that the dollar-euro spot rate is

Q79: From the perspective of the writer of

Q86: Find the risk neutral probability of an