Multiple Choice

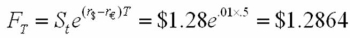

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is  .The six-month U.S.dollar rate is 5% and the Eurodollar rate is 4%.The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

.The six-month U.S.dollar rate is 5% and the Eurodollar rate is 4%.The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

A) 0 cents

B) 3.47 cents

C) 3.55 cents

D) 3 cents

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In which market does a clearinghouse serve

Q6: A CME contract on €125,000 with September

Q44: The same call from the last question

Q54: Verify that the dollar value of your

Q57: For European options, what of the effect

Q70: Suppose you observe the following 1-year interest

Q73: Draw the tree for a put option

Q79: Draw the tree for a call option

Q83: You have written a call option on

Q86: Find the risk neutral probability of an