Multiple Choice

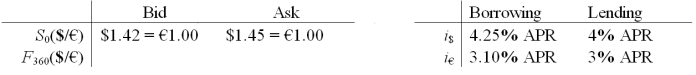

Consider a bank dealer who faces the following spot rates and interest rates.What should he set his 1-year forward ask price at?

A) $1.4324/€

B) $1.4358/€

C) $1.4662/€

D) $1.4676/€

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Suppose that the one-year interest rate is

Q2: Suppose you observe a spot exchange rate

Q61: If you borrowed €1,000,000 for one year,

Q63: One implication of the random walk hypothesis

Q72: If you had €1,000,000 and traded it

Q73: When Interest Rate Parity (IRP) does not

Q75: According to the research in the accuracy

Q91: Will an arbitrageur facing the following prices

Q94: Which of the following issues are

Q97: USING YOUR PREVIOUS ANSWERS and a bit