Multiple Choice

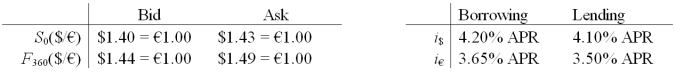

Will an arbitrageur facing the following prices be able to make money?

A) Yes, borrow €1,000,000 at 3.65%; Trade for $ at the bid spot rate $1.40 = €1.00; Invest at 4.1%; Hedge this with a long position in a forward contract.

B) Yes, borrow $1,000,000 at 4.2%; Trade for € at the spot ask exchange rate $1.43 = €1.00; Invest €699,300.70 at 3.5%; Hedge this by going SHORT in forward (agree to sell € @ BID price of $1.44/€ in one year) .Cash flow in 1 year $237.76.

C) No; the transactions costs are too high.

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Suppose that the one-year interest rate is

Q39: There is (at least) one profitable arbitrage

Q61: If you borrowed €1,000,000 for one year,

Q72: If you had €1,000,000 and traded it

Q75: According to the research in the accuracy

Q86: Consider a bank dealer who faces the

Q89: A higher U.S.interest rate (i<sub>$</sub>

Q94: Which of the following issues are

Q96: Consider a bank dealer who faces the

Q97: USING YOUR PREVIOUS ANSWERS and a bit