Multiple Choice

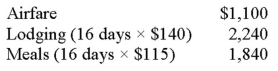

Byron took a business trip from Philadelphia to Rome.He was away 16 days of which he spent 9 days on business (including two travel days) and 7 days vacationing.His expenses are as follows:  Byron's total travel (including meals and lodging) expense deduction rounded to the nearest dollar is:

Byron's total travel (including meals and lodging) expense deduction rounded to the nearest dollar is:

A) $2,396.

B) $2,878.

C) $3,395.

D) $5,180.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: "Listed property" includes only passenger automobiles.

Q22: Education expenses are deductible if the education

Q27: The §179 expense deduction is limited to

Q33: Which expenses incurred in a trade or

Q36: Meals and entertainment expenses are limited to

Q45: In June 2014,Kelly purchased new equipment for

Q48: Chris runs a business out of her

Q53: When business property is lost in a

Q62: Taxpayers must use the mid-month convention when

Q63: The luxury auto limits on depreciation must