Multiple Choice

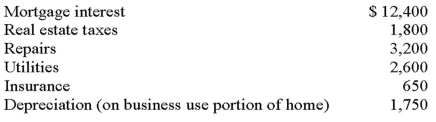

Chris runs a business out of her home.She uses 500 square feet of her home exclusively for the business.Her home is 2500 square feet in total.Chris had $36,000 of business revenue and $32,000 of business expenses from her home business.The following expenses relate to her home:  What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

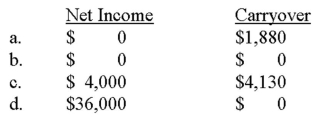

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Education expenses are deductible if the education

Q27: The §179 expense deduction is limited to

Q33: Which expenses incurred in a trade or

Q34: In order for an employee to deduct

Q45: In June 2014,Kelly purchased new equipment for

Q46: Byron took a business trip from Philadelphia

Q52: Ted purchased a vehicle for business and

Q53: When business property is lost in a

Q62: Taxpayers must use the mid-month convention when

Q63: The luxury auto limits on depreciation must