Multiple Choice

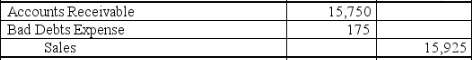

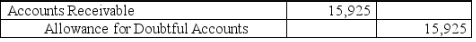

A company ages its accounts receivables to determine its end of period adjustment for bad debts.At the end of the current year,management estimated that $15,750 of the accounts receivable balance would be uncollectible.Prior to any year-end adjustments,the Allowance for Doubtful Accounts had a debit balance of $175.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

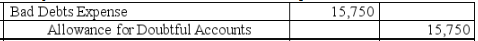

A)

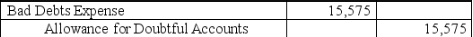

B)

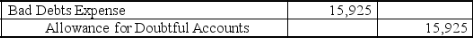

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The materiality constraint permits the use of

Q45: A company allows its customers to use

Q53: A company uses the percent of sales

Q54: A 90-day note issued on April 10

Q56: Explain the basic difference between estimating the

Q58: Notes receivable are always classified as current

Q59: On December 31,of the current year,a company's

Q126: A company had net sales of $500,000

Q135: The accounts receivable turnover is calculated by:<br>A)

Q162: The amount due on the maturity date