Multiple Choice

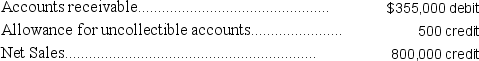

A company uses the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 0.6% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $2,130; credit Allowance for Doubtful Accounts $2,130.

B) Debit Bad Debts Expense $2,630; credit Allowance for Doubtful Accounts $2,630.

C) Debit Bad Debts Expense $4,300; credit Allowance for Doubtful Accounts $4,300.

D) Debit Bad Debts Expense $4,800; credit Allowance for Doubtful Accounts $4,800.

E) Debit Bad Debts Expense $5,300; credit Allowance for Doubtful Accounts $5,300

Correct Answer:

Verified

Correct Answer:

Verified

Q2: The materiality constraint permits the use of

Q45: A company allows its customers to use

Q54: A company ages its accounts receivables to

Q54: A 90-day note issued on April 10

Q56: Explain the basic difference between estimating the

Q58: Notes receivable are always classified as current

Q64: A company borrowed $10,000 by signing a

Q126: A company had net sales of $500,000

Q135: The accounts receivable turnover is calculated by:<br>A)

Q162: The amount due on the maturity date