Multiple Choice

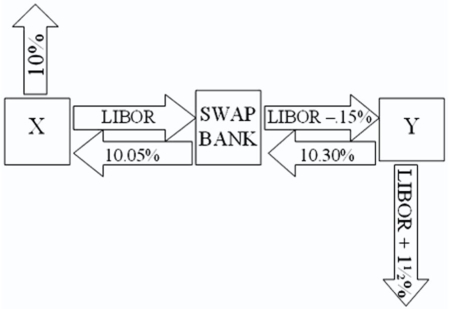

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05 percent.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

A) The swap bank will earn 40 basis points per year on $10,000,000 = $40,000 per year.

B) The swap bank will earn 10 basis points per year on $10,000,000 = $10,000 per year.

C) The swap bank will lose money.

D) none of the options

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A swap bank makes the following

Q14: Company X wants to borrow $10,000,000

Q15: Find the all-in-cost of a swap to

Q16: Consider the situation of firm A

Q17: Suppose that the swap that you proposed

Q19: Compute the payments due in the

Q20: Consider the situation of firm A

Q21: Consider the situation of firm A

Q22: In an interest-only currency swap<br>A)the counterparties must

Q23: A swap bank<br>A)can act as a broker,bringing