Multiple Choice

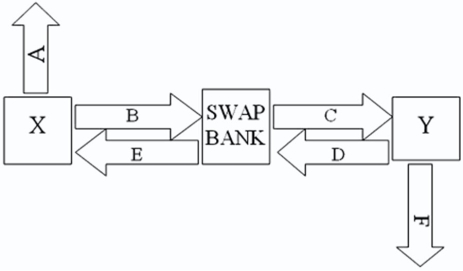

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank is involved and quotes the following rates five-year dollar interest rate swaps at 10.05 percent?10.45 percent against LIBOR flat.  Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

Assume both X and Y agree to the swap bank's terms.Fill in the values for A,B,C,D,E,& F on the diagram.

A) A = LIBOR; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = 12%

B) A = 10%; B = 10.45%; C = 10.05%; D = LIBOR; E = LIBOR; F = LIBOR + 1½%

C) A = 10%; B = 10.45%; C = LIBOR; D = LIBOR; E = 10.05%; F = LIBOR + 1½%

D) A = 10%; B = LIBOR; C = LIBOR; D = 10.45%; E = 10.05%; F = LIBOR + 1½%

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Consider the situation of firm A

Q10: Consider the borrowing rates for Parties

Q11: Consider the situation of firm A

Q12: A swap bank has identified two companies

Q13: A swap bank makes the following

Q15: Find the all-in-cost of a swap to

Q16: Consider the situation of firm A

Q17: Suppose that the swap that you proposed

Q18: Company X wants to borrow $10,000,000

Q19: Compute the payments due in the